Shell corporation law and legal definition a shell corporation is a company which serves as a vehicle for business transactions without having any significant assets or operations.

Are shelf corporations legal.

The company can then be sold to a person or group of persons who wish to start a company without going through all the procedures of creating a new one.

They are frequently used for holding personal or business assets.

It is in good standing with current tax returns.

While they cost a bit more they are well worth the money as these established companies often have immediate credit.

Was established on october 19 1992 and published a bi annual circular that was sent out to its fan club.

It was created and left with no activity metaphorically put on the shelf to age.

Shell corporations are not illegal and they may have legitimate business purposes.

Shell corporations are legitimate legal entities that do not possess actual assets or run business operations.

A person forms a company usually in a state like montana or wyoming where the filing fees are inexpensive and puts it on a shelf.

Whether or not a shelf corporation is ultimately considered legal or illegal comes down to two important factors.

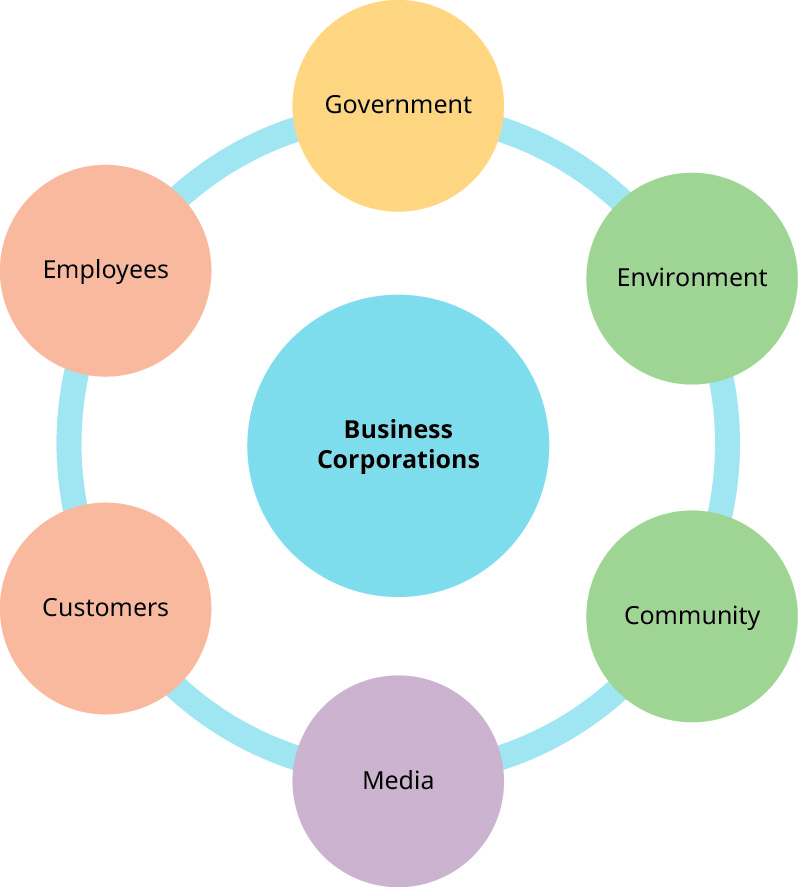

They function as transactional vehicles for a variety of firms and for a myriad of.

They do nothing with the corporation other than file the annual reports and cover the annual fees.

If you buy a shelf corporation with a seasoned credit profile and use that credit to secure a loan you wouldn t have been able to qualify for normally you may be crossing the line.

Wild west arts club inc.

A shelf corporation shelf company or aged corporation is a company or corporation that has had no activity.

A shelf corporation is a company that was created years ago for the sole purpose of being sold in the future simply for the value of its age.

It all depends upon how a shelf llc is created and how it is used.